2017 Capital Highlights - In the Markets

November 2017: Dow Jones Industrial Average was the Big Winner

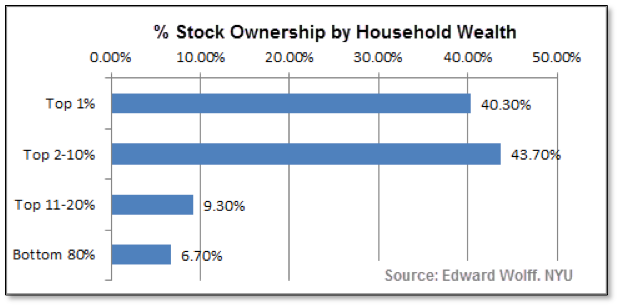

As the stock market continues to hit new highs it might be a shock to hear how few Americans actually own stock. According to a detailed study of stock ownership by New York University economist Edward Wolff, 84% of stocks available in the United States are owned by just the top 10% most-wealthy households. Furthermore, more than 93% of all stock is owned by just the top 20% of households. That means that the bottom 80% of households in the United States only own about 7% of the total stock market. And, he notes, his research includes everything, direct ownership of stocks and indirect ownership through mutual funds, trusts, IRA’s, Keogh plans, and other retirement accounts. Put bluntly, the policies of the Fed and the government that set the stage for the current long bull market greatly favored the rich, and they indeed got very much richer.

October 2017: Strong Gains Across the Board for the US for Q3

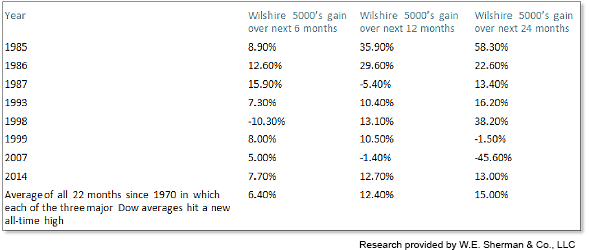

An unusual event occurred in the market during September. For the first time in more than three years, each of the three major Dow stock market averages all hit all-time highs during the month. The central tenet of the venerable “Dow Theory” is that a new high by one of the indexes, traditionally the Dow Industrials, is considered very bullish if confirmed by the Dow Transports, and even more bullish if the third (the Dow Utilities) joins in. The late Richard Russell, long-time proponent of the Dow Theory, called this a “Super Dow Theory” signal.

September 2017: Private-Sector Job Growth Surged Last Month

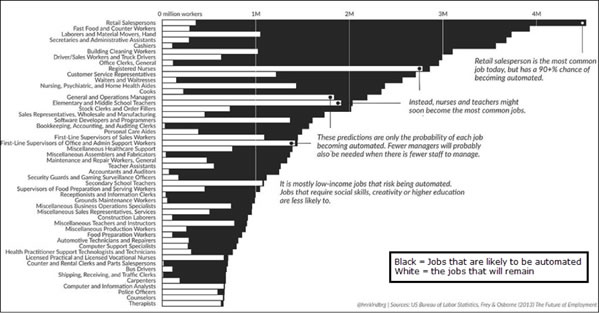

Using data from a comprehensive employment report from the University of Oxford, Henrik Lindberg, chief technology officer at Swedish financial technology company Zimpler developed a chart depicting which jobs were most likely to be taken over by robots. According to his data, the first jobs to be performed by robots will be those working as retail clerks, fast food workers, and secretaries. He doesn’t say exactly when it will happen, but he expects that within 10 to 20 years, about 50% of jobs in existence today will transition to automation. Lindberg believes that occupations which will remain in demand are those that require the human characteristics of compassion, understanding, and moral judgement, such as nurses, teachers, and police officers.

August 2017: An Indicator of Future Home Sales Rebounded

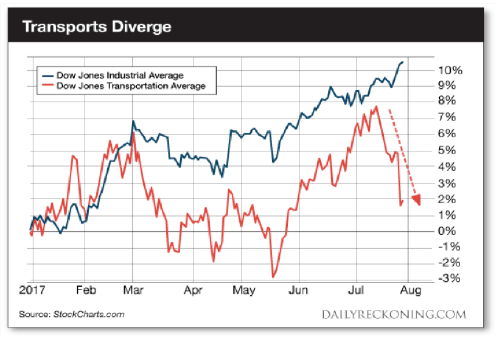

An old Wall Street saying goes something like “When the soldiers leave the field of battle, the generals are soon to follow.” The meaning is that when the few stock market leaders are all alone, and most other stocks have already turned down…the few leaders are likely to follow as well. Mid Cap and Small Cap stocks have broken down recently, and now the important Transports sector has diverged sharply from the Dow Jones Industrials. A venerable market theorem, “The Dow Theory”, raises red flags when the Dow Industrials and the Transports diverge significantly.

July 2017: Gridlock in Washington Continues to Weigh on Economic Expectations

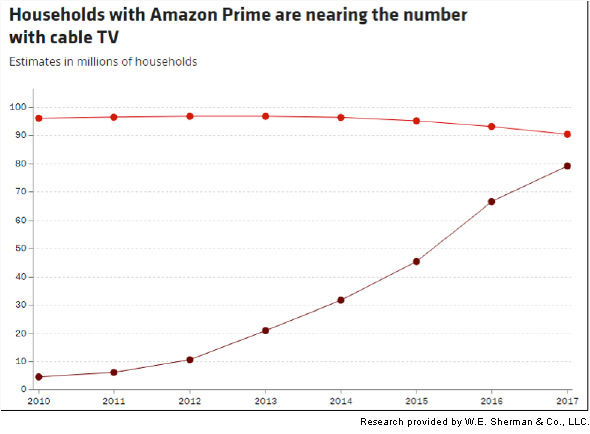

According to estimates from Morningstar, nearly 79 million households now have an Amazon Prime membership, up from 66 million at the end of 2016. This compares to a projected 90 million households that pay for cable or satellite TV. Amazon doesn’t disclose the number of Prime members, so Morningstar’s estimates are based on an analysis of Amazon’s cash-flow statements. On the day after Prime Day, Amazon said they had more new members joining the Prime subscription service on Prime Day than any other single day in history.

June 2017: Stocks Rallied for a Second Week

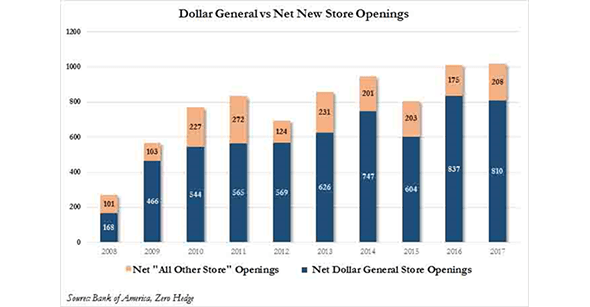

This week online retailer Amazon closed above $1000 a share for the first time in its history as Americans more and more become accustomed to the convenience of shopping at home and having a package show up at their door two days later. More than a few people have described the experience as a “Christmas every day” phenomenon where boxes filled with items they had forgotten they had ordered appear on their doorsteps day after day. Amidst this new shopping experience, brick-and-mortar store chains by the dozens have sunk into bankruptcy as consumers no longer walk their aisles.

May 2017: Commodity Weakness Continues in the Energy Sector

RBC Global Asset Management released a research note with an interesting insight. They found that when the Conference Board’s Leading Economic Indicators (LEI) index was rising month-to-month and was already above zero year-over-year, the stock market averaged an 11.8% gain in the following 12 months. The last time this happened was just before the U.S. presidential election - and the strong market rally then followed. From the RBC note: “Improvement in the LEI is meaningful because stocks have returned an annualized average of 11.8% in periods where the LEI is positive and rising as it is now, compared with just 0.3% when the LEI is positive but falling, which was the case prior to the start of the latest rally.” As of its latest reading, the LEI continued to strengthen from an above-zero condition. According to this measure, at least, it seems there are prospects for more gains. As always, past performance is no guarantee of future results.

April 2017: Home Prices Surged to Their Highest Level in Nearly Three Years

While the U.S. Civil War officially ended in 1865, a trio of researchers from the Washington D.C.-based think tank Center for Economic and Policy Research (CEPR) released a paper asserting that the United States still remains a nation of two countries. The authors wrote, “For the 117 million U.S. adults in the bottom half of the income distribution, growth has been nonexistent for a generation, while at the top of the ladder it has been extraordinarily strong.” The researchers discovered that for the working class, income has actually dropped.

March 2017: Consumers Confidence at a 15 year high

Everyone knows that one of the original smartphone pioneers was Blackberry. In fact, for some time, it was the dominant smartphone. Back in 2011, Blackberry’s handset sales peaked at over 52 million units. But as iPhone and Android sales gained ground, Blackberry’s share of the market slid precipitously. The reasons are myriad, but in short Blackberry devices were surpassed by the hardware and most importantly the apps and software available for the Apple iPhone and Google Android devices. Despite numerous attempts featuring new hardware and software, Blackberry has never been able to regain even a shadow of its former glory.

February 2017: Job Growth Details

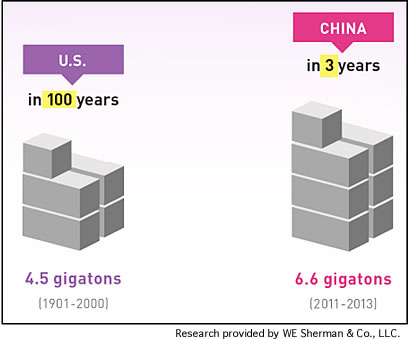

Multi-billionaire Microsoft founder Bill Gates recently wrote on his GatesBlog, “This might be the most mind-blowing fact I learned this year”, followed by a graphic of Chinese cement usage over the last 3 years. In short, China has used more cement in the last 3 years than the United States has used in the last 100 years! China’s 6.6 gigatons of cement, consumed in 3 years, dwarfs the U.S.’ 4.5 gigatons, consumed in 100 years. Here’s the amazing graphic provided by Mr. Gates.

January 2017: Predictions

A survey by Washington D.C.-based think tank Pew Research Center showed that living with parents is now “the most common young adult living arrangement for the first time on record” and that millennials are less likely to be married by the time they are 34 than any previous generation. One possible major cause for the delay in reaching these milestones may be student loan payments. In a survey from bankrate.com, more than 56% of millennials said they have delayed a major life event because of their student loan debt. The following chart, from marketwatch.com, details these “milestone” discrepancies.