2019 Capital Highlights - In the Markets Archives

DEC 2019: Consumer Spending Rose

Growing optimism about a “phase one” trade deal between the U.S. and China helped stocks close higher for the holiday-shortened week.

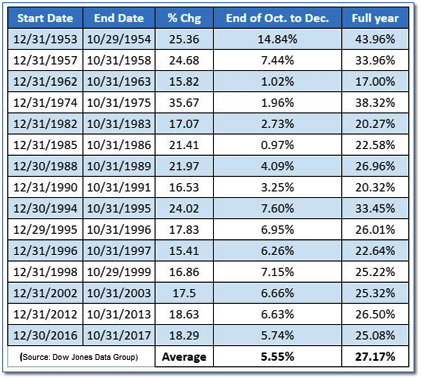

NOV 2019: If a 70-year tendency holds true ...

Read More

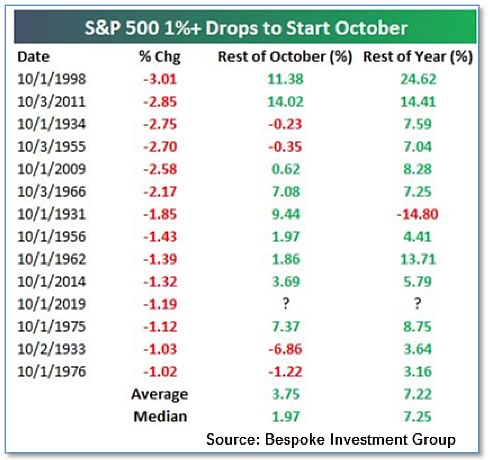

OCT 2019: A Lousy Start to October?

The month of October has experienced some of the worst market crashes in history.

Read More

SEPT 2019: Investment Contrarians

Investment “contrarians” are those who look for extremes in sentiment as signals that it is time to “go the other way”.

Read More

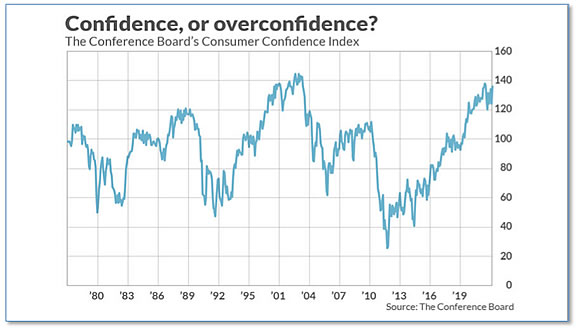

AUG 2019: Confidence or Overconfidence

One non-obvious but historically accurate predictor of the stock market just hit its most bearish level since the internet bubble, says Marketwatch analyst Mark Hulbert. It turns out July’s big increase in consumer confidence was actually bearish for the market, since the Conference Board’s Consumer Confidence Index (CCI) is a contrarian market indicator at its extremes.

Read More

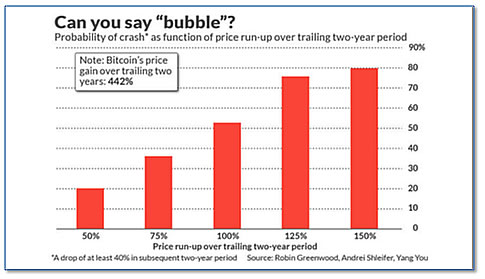

JULY 2019: Remember Bitcoin?

Three researchers at Harvard have determined that parabolic rises in asset prices of the magnitude shown by Bitcoin in both its earlier and more recent leaps higher give way to crashes 80% of the time over a long and storied history of bubbles and collapses (“Bubbles for Fama”, Journal of Financial Economics).

Read More

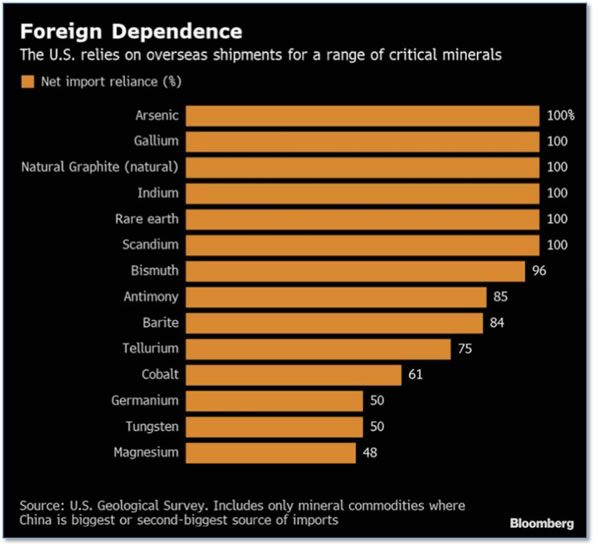

JUNE 2019: Dangerous Mineral Dependence

According to media reports from China, Beijing appears to be gearing up its use of dominance in what are known as “rare earth metals” as a counter to its trade battle with Washington.

Read More

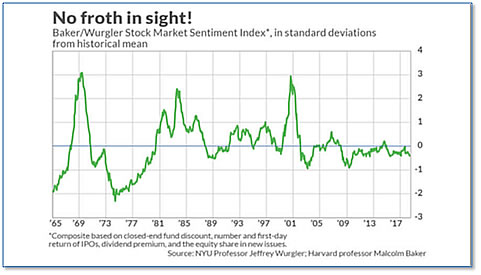

MAY 2019: The Bull Market

Is the bull market in stocks, now in its tenth year, reaching the frothy, speculative stage that is typical of a major top? Not according to an indicator created by top minds at the Harvard School of Business and NYU.

Read More

APR 2019: The Habits of Super Savers

When brokerage firm TD Ameritrade surveyed its clients who it deemed “Super Savers” for saving 20% or more of their incomes, they found something radically different.

Read More

Mar 2019: Market Weakness Going Forward?

According to some on Wall Street, the stock market’s monster rally from its Christmas Eve low is hard to explain – or justify – from a fundamental standpoint. The market’s more than 18% comeback coincided with a wave of downward growth and earnings revisions that lowered analysts’ expectations for first-quarter earnings and GDP growth.

Read More

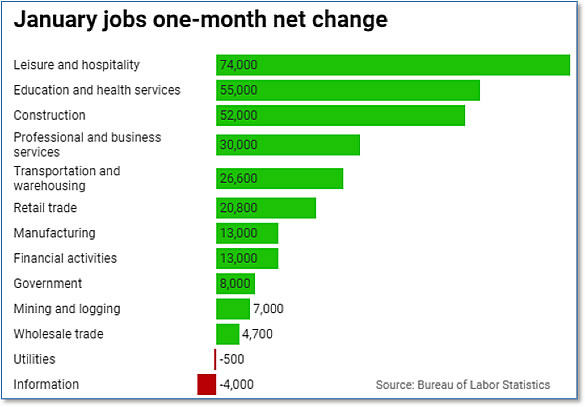

Feb 2019: Jobs

Several months in the last year and now two months in a row, the “Information” industry segment has actually shrunk its employment while nearly all other industries are adding. January’s “blowout” and “beyond all expectations” jobs number had one stinker in it: a loss of 4,000 jobs in the “Information” industry.

Read More

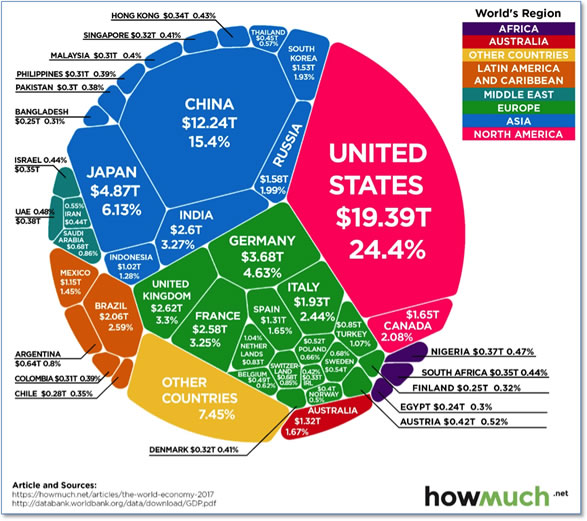

Jan 2019: Economies

It is generally known that the United States economy is the world’s largest, with China a distant (but growing) second. But other than that, most people are unaware of how just how big the U.S. economy is relative to the rest of the world.